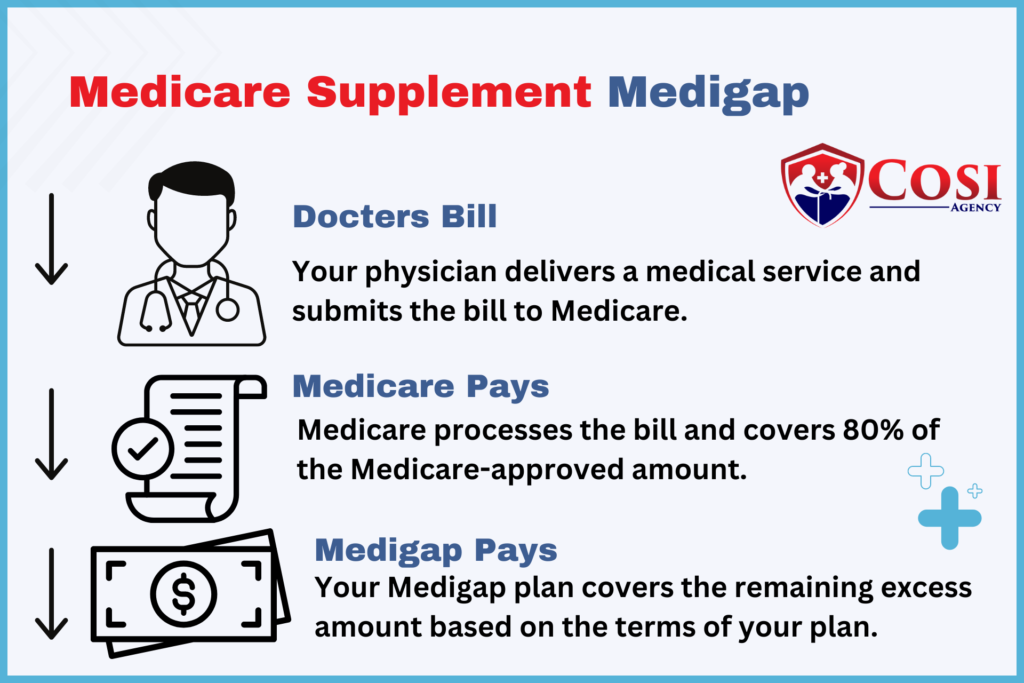

Medicare Supplement Plans, also known as Medigap, are health insurance policies sold by private companies to help fill in the “gaps” in Original Medicare coverage.

These plans can assist with out-of-pocket costs such as copayments, coinsurance, and deductibles, providing beneficiaries with greater financial security and peace of mind regarding their healthcare expenses.

There are several standardized Medicare Supplement Plans available, labeled with letters from A to N (excluding E, H, I, and J). Each plan offers a different combination of benefits, allowing beneficiaries to choose the one that best suits their individual healthcare needs and budget.

Here’s a brief overview of the coverage provided by each plan:

While Original Medicare provides valuable healthcare coverage for eligible individuals aged 65 and older, it does not cover all healthcare costs. Medicare beneficiaries are often responsible for copayments, coinsurance, deductibles, and other out-of-pocket expenses, which can quickly add up, especially for those with significant healthcare needs.

Medicare Supplement insurance helps fill these gaps in coverage, providing beneficiaries with financial protection and ensuring access to the healthcare services they need without facing overwhelming costs. By enrolling in a Medicare Supplement Plan, individuals can enjoy greater flexibility in choosing healthcare providers and peace of mind knowing that their out-of-pocket expenses will be minimized

Medigap policies are popular among Medicare beneficiaries because they can include benefits that help pay health care costs Original Medicare doesn’t, like:

Other advantages can include:

Medicare Supplement Plans, also known as Medigap, are a valuable resource for many Medicare beneficiaries, offering coverage for out-of-pocket expenses not covered by Original Medicare. One common question that arises is whether these plans are guaranteed issue.

In general, Medicare Supplement Plans do have guaranteed issue rights in certain situations. This means that insurance companies offering these plans are required to sell them to eligible individuals without considering pre-existing conditions, health status, or other factors that could affect coverage eligibility.

Here are some scenarios in which Medicare Supplement Plans are guaranteed issue:

Initial Enrollment Period (IEP): The best time to enroll in a Medicare Supplement Plan is during your Medigap Open Enrollment Period, which starts automatically when you’re 65 or older and enrolled in Medicare Part B. During this period, you have guaranteed issue rights, meaning you can enroll in any Medicare Supplement Plan available in your area without medical underwriting.

Special Enrollment Periods (SEPs): In certain situations, you may qualify for a Special Enrollment Period, which grants you guaranteed issue rights for a Medicare Supplement Plan. These situations could include losing other health coverage, moving out of your plan’s service area, or losing coverage due to a Medicare Advantage plan termination.

State-Specific Protections: Some states have additional rules and regulations regarding guaranteed issue rights for Medicare Supplement Plans. These state-specific protections may provide additional opportunities to enroll in a plan without medical underwriting, beyond the federal guidelines.

Evaluate various Medicare options.

Request pricing details from insurers or brokers.

Consult experts for personalized guidance.

Missing your Medigap Open Enrollment Period means you might face medical underwriting when applying for coverage, potentially leading to higher premiums or denial. You may have fewer coverage options and could be subject to pre-existing condition waiting periods. While some states offer additional enrollment rights, it’s best to enroll during your initial period to secure coverage without these hurdles.

Let us help you navigate your Options that aligns with your healthcare needs and budget

Schedule a free consultation with us today

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.

©2023 COSI Agency – All rights reserved

Designed by Top-Rated