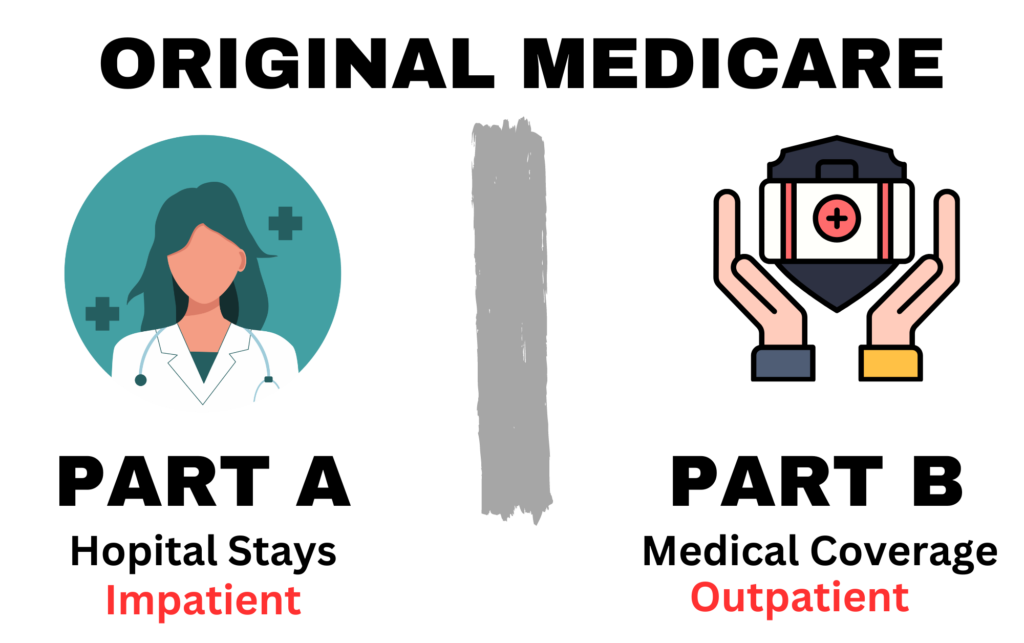

Medicare is a federally funded health insurance program in the United States primarily designed for individuals aged 65 and older, though it also covers certain younger individuals with disabilities and those with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS). It consists of different parts, each covering specific healthcare services. Medicare Part A, often referred to as Hospital Insurance, helps cover inpatient hospital care, skilled nursing facility care, hospice care, and some home health care. Medicare Part B, known as Medical Insurance, covers certain doctor services, outpatient care, medical supplies, and preventive services.

In addition to Parts A and B, Medicare beneficiaries have the option to enroll in Medicare Advantage (Part C) plans offered by private insurance companies approved by Medicare. These plans provide all the benefits of Parts A and B and often include additional coverage, such as prescription drugs, dental, vision, and wellness programs. Medicare Part D offers prescription drug coverage through private insurance plans approved by Medicare, helping beneficiaries manage the costs of their medications. Together, these components make up the Medicare program, providing essential healthcare coverage to millions of Americans across the country.

Medicare operates as a federal health insurance program designed to provide coverage for eligible individuals in the United States. Funded through payroll taxes, premiums, and federal revenues, Medicare functions as a system of different parts, each covering specific healthcare services.

Medicare Part A, known as Hospital Insurance, typically covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services. Beneficiaries usually do not pay a monthly premium for Part A if they or their spouse paid Medicare taxes while working.

Medicare Part B, also called Medical Insurance, covers certain doctor services, outpatient care, medical supplies, and preventive services. Beneficiaries typically pay a monthly premium for Part B, along with deductibles and coinsurance.

Medicare Advantage (Part C) plans, offered by private insurance companies approved by Medicare, provide an alternative to Original Medicare (Parts A and B). These plans often include additional benefits such as prescription drug coverage, dental, vision, and wellness programs, and may have different costs and coverage rules than Original Medicare.

Medicare Part D offers prescription drug coverage through private insurance plans approved by Medicare. Beneficiaries can choose a Part D plan from various options to help cover the costs of their medications.

Overall, Medicare works by providing eligible individuals with access to essential healthcare services through a combination of government-funded coverage and private insurance options, helping to ensure that beneficiaries have access to necessary medical care as they age or face health challenges.

Medicare Supplement Plans, also known as Medigap, are private insurance policies designed to help fill the gaps in coverage left by Original Medicare (Parts A and B). These plans are offered by private insurance companies and are standardized by the federal government, meaning that each plan provides the same basic benefits regardless of the insurance company offering it.

Medicare Supplement Plans typically cover certain out-of-pocket costs such as deductibles, coinsurance, and copayments associated with Original Medicare. Some plans may also offer additional benefits, such as coverage for medical care received while traveling outside the United States.

One of the key advantages of Medicare Supplement Plans is the flexibility they offer. Beneficiaries can choose from a variety of plans to find the coverage that best meets their needs and budget. Additionally, because Medigap policies are standardized, beneficiaries can compare plans easily to determine which one offers the best value for their individual circumstances.

It’s important to note that Medicare Supplement Plans cannot be used to pay for services that are not covered by Original Medicare, such as long-term care, dental care, vision care, or hearing aids. However, for those who want the peace of mind of knowing that their out-of-pocket healthcare costs will be minimized, Medicare Supplement Plans can be a valuable addition to their Medicare coverage.

There are ten Medigap plans available today, each labeled by a letter of the alphabet. They include Plans A, B, C, D, F, G, K, L, M, and N. Note that we use the word ‘plans’ for Medigap policies versus ‘parts’ for the parts of Medicare. It’s easy to see why so many people find Medicare confusing! With each plan offering different levels of coverage and benefits, understanding the differences between them can be challenging.

Navigating Medicare enrollment periods is essential for ensuring timely access to healthcare coverage. From Initial Enrollment Periods to Special Enrollment Periods and Annual Enrollment Periods, each has specific eligibility criteria and timing requirements. Understanding these periods can help you avoid coverage gaps and potential penalties.

Medicare Advantage plans offer at least as much coverage as Original Medicare, but almost all of them offer even more coverage. For example, you can bundle your prescription drug coverage into your Medicare Advantage plan – for no additional premium! Many plans also include benefits for hearing, vision, and dental care. They often include wellness programs, gym memberships, transportation, meal delivery, and monthly over-the-counter stipends.

One of the key advantages of Medicare Advantage Plans is the convenience of having all your healthcare coverage bundled into one plan. Instead of managing separate plans for hospital and medical coverage, beneficiaries can have all their benefits coordinated under a single plan with one insurer. Additionally, Medicare Advantage Plans may offer cost-saving opportunities, such as lower monthly premiums or out-of-pocket costs compared to Original Medicare. However, it’s essential to carefully review the coverage and network restrictions of each plan to ensure it meets your healthcare needs and preferences.

Medicare Advantage (Part C) offers extra benefits beyond Original Medicare, like prescription drug coverage and dental care, provided by private insurers approved by Medicare.

You can switch between Original Medicare and Medicare Advantage during the Annual Enrollment Period (October 15 to December 7) or other qualifying periods.

Additional benefits of Medicare Advantage may include dental, vision, hearing, fitness memberships, transportation, and over-the-counter stipends.

Discover the most cost-effective Medicare plans available in your vicinity.

Schedule a free consultation with us today

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.

©2023 COSI Agency – All rights reserved

Designed by Top-Rated