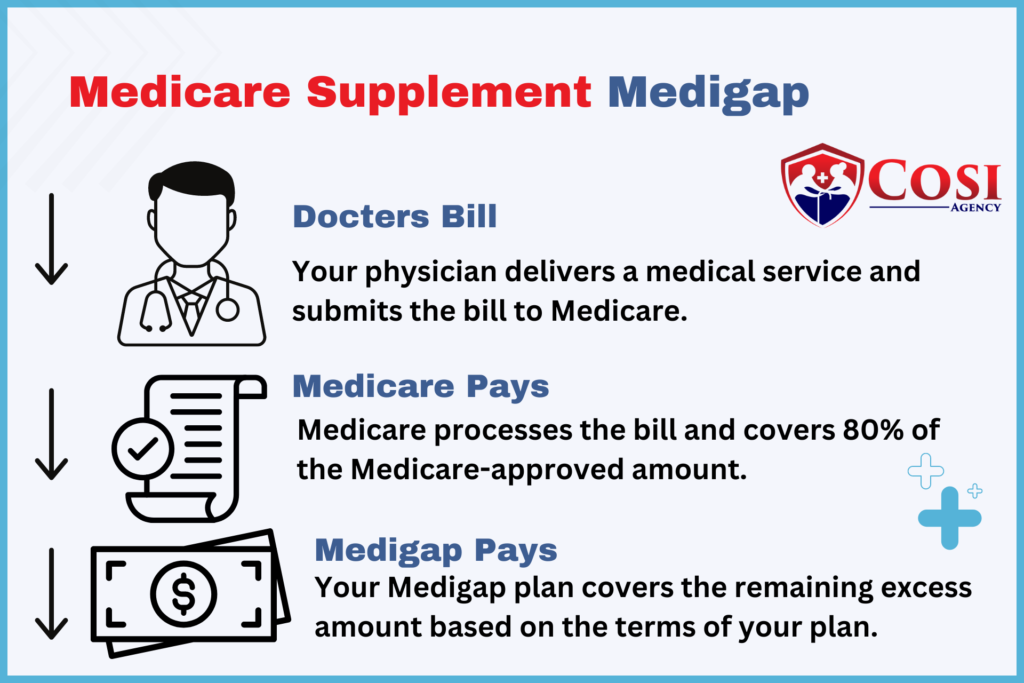

Medicare Supplemental Insurance, also known as Medigap, is a type of private insurance that helps cover some of the healthcare costs that Original Medicare doesn’t cover, such as copayments, coinsurance, and deductibles.

There are several standardized Medicare Supplement plans, each labeled with a letter (A, B, C, D, F, G, K, L, M, N). While the benefits are standardized across plans of the same letter, the costs may vary depending on the insurance company offering the plan. Each plan offers different levels of coverage, so beneficiaries can choose the one that best fits their healthcare needs and budget.

It’s essential to compare the benefits and costs of each plan before making a decision.

Medicare Supplemental Insurance, or Medigap, is private health insurance designed to fill gaps in coverage left by Medicare Part A and Part B. Standardized plans, labeled A to N, offer varying levels of coverage for copayments, coinsurance, and deductibles. Beneficiaries with Medicare Parts A and B are eligible, but Medigap does not cover services like dental, vision, or prescription drugs.

It provides added financial protection and peace of mind by helping cover out-of-pocket costs associated with Original Medicare.

Choosing the right Medicare Supplement plan depends on factors like your healthcare needs, budget, and personal preferences.

Evaluate your coverage gaps, compare plan benefits, and consider future healthcare needs. Consulting with a licensed agent can provide guidance.

The Medicare Supplement plan with the highest coverage is Plan F. It offers comprehensive coverage, paying for all Medicare-covered expenses that Original Medicare doesn’t cover, including deductibles, coinsurance, and copayments. However, Plan F is no longer available to new Medicare beneficiaries as of 2020.

If you enrolled in Medicare before this date, you may still be eligible for Plan F. Another high-coverage option is Plan G, which provides similar benefits to Plan F but requires you to pay the Part B deductible out of pocket.

Consulting with a Medicare specialist can help you determine the best plan for your needs.

You can enroll in a Medigap insurance plan during your Medigap Open Enrollment Period, which begins when you’re 65 or older and enrolled in Medicare Part B. This six-month period is the best time to enroll because insurance companies cannot deny you coverage or charge you higher premiums based on your health status. If you miss this initial enrollment period, you may still be able to enroll in a Medigap plan, but insurance companies may charge you higher premiums or deny coverage based on your health history. Additionally, some states have additional enrollment periods or guaranteed issue rights that allow you to enroll in a Medigap plan outside of the initial enrollment period. It’s important to be aware of these enrollment periods and your rights to ensure you can enroll in a plan that meets your needs.

Evaluate various Medicare options.

Request pricing details from insurers or brokers.

Consult experts for personalized guidance.

Let us help you navigate your Options that aligns with your healthcare needs and budget

Schedule a free consultation with us today

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.

©2023 COSI Agency – All rights reserved

Designed by Top-Rated